Credit Cards

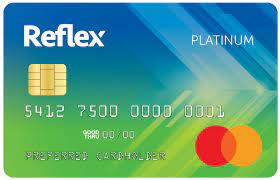

Are you in debt and need a credit limit? Meet Reflex Mastercard® limit up to $800!

Rebuild your credit and unlock a brighter financial future with the Reflex Mastercard® Credit Card. Get a manageable credit limit of up to $800 and access powerful tools to improve your credit score.

Advertisement

Have a credit card for those in debts – Meet Reflex Mastercard®!

Struggling with debt and seeking a path to rebuild credit? Consider the Reflex Mastercard® Credit Card as your go-to solution! Tailored to assist those in debt, this card offers a credit limit of up to $800, empowering individuals to regain control of their financial situation.

In this comprehensive guide, all aspects of the Reflex Mastercard® Credit Card will be explored, including its advantages, disadvantages, credit score requirements, and application process. Prepare to embark on a journey that unlocks new financial possibilities!

See all about the Reflex Mastercard® Credit Card

Specifically designed for individuals facing debt challenges, the Reflex Mastercard® Credit Card provides a credit limit of up to $800, enabling effective expense management and credit score improvement.

The Power of Credit Building Unleashed

Escape from the clutches of debt and assume control of your financial journey. By granting a credit limit of up to $800, individuals are empowered by the Reflex Mastercard® Credit Card to efficiently manage expenses while showcasing responsible credit card usage.

| Credit Score | 300 or higher |

| Annual Fee | See terms |

| Regular APR | 24.99% – 29.99% |

| Welcome bonus | No |

| Rewards | No |

A Streamlined Credit Rebuilding Process

Recognizing the challenges associated with rebuilding credit history, the Reflex Mastercard® Credit Card has implemented measures to simplify the process.

Through the documentation of responsible credit behavior and its subsequent positive influence on credit scores, achieved by reporting payment activity to all three major credit bureaus. This card offers individuals the opportunity to exhibit financial responsibility and pave the way for an enhanced credit future.

An Emphasis on Enhanced Financial Education

Supporting cardholders in enhancing their financial knowledge and skills, the Reflex Mastercard® Credit Card provides access to resources and educational materials. These valuable tools enable users to make well-informed decisions concerning credit management, budgeting, and personal finance. By empowering individuals with knowledge, this card encourages long-term financial stability.

A Personalized Approach to Credit Limit Evaluation

When determining credit limits, the Reflex Mastercard® Credit Card takes into account the unique financial situations of its applicants.

Rather than relying solely on traditional credit scores, the card issuer considers factors such as income, employment history, and debt-to-income ratio. This personalized evaluation enhances the likelihood of approval while ensuring that the assigned credit limit aligns with the applicant’s financial capacity.

Advantages to consider

The Reflex Mastercard® Credit Card comes with several advantages that can assist you in overcoming financial hurdles. Some key benefits include:

- Build Your Credit: Through responsible usage of the Reflex Mastercard® Credit Card, including making timely payments and maintaining low balances, you can showcase your creditworthiness and steadily enhance your credit score.

- Accessible Credit Limit: With a credit limit of up to $800, you have the flexibility to address your financial requirements while effectively managing your credit utilization ratio.

- Flexible Payment Options: The Reflex Mastercard® Credit Card offers a range of payment choices tailored to your preferences. Whether you prefer online payments through their user-friendly platform, automatic payment setups for timely bill settlement, or traditional payment methods via phone or mail, the card accommodates your needs.

- Effective Account Management: The card’s online platform provides comprehensive tools to manage your account effectively. Stay informed about your transactions, access statements, and effortlessly track your spending to stay in control of your financial activities.

- Convenience in Application: Applying for the Reflex Mastercard® Credit Card is hassle-free. Simply visit their website or follow their customer service guidance for a smooth and convenient application process.

Disadvantages to consider

While the Reflex Mastercard® Credit Card presents numerous advantages, it’s crucial to acknowledge potential disadvantages:

- Annual Fee: The Reflex Mastercard® Credit Card incurs an annual fee that necessitates inclusion in financial planning.

- Limited Rewards: Unlike certain credit cards, the Reflex Mastercard® Credit Card does not offer rewards or cashback programs, with its primary focus centered on credit building and financial management.

What credit score do I need?

It is not possible to say with 100% certainty the score required. However, it caters to individuals with debt and less-than-perfect credit scores. Thus, even with a lower credit score, you remain eligible for this card.

Obtain the Reflex Mastercard® Credit Card right now!

Eager to acquire the Reflex Mastercard® Credit Card and embark on a journey toward a brighter financial future? Click the button below to access the subsequent page, where the application process will be guided, and all essential information to initiate your path to financial success will be provided.

About the author / Beatriz Martinez

Trending Topics

Apply for Revvi Card for poor credit! Limit up to $360

Need a fresh start with credit? Revvi Card offers a lifeline for poor credit holders, providing a credit limit of up to $360.

Keep Reading

Credit Card Destiny Mastercard for no credit! Credit Limit up to $1.000

Unlock your financial destiny with the Destiny Mastercard! Enjoy low interest rates, cashback rewards, and build your credit score.

Keep Reading

Surge Mastercard for people in debt! Credit limit up to $550

Surge Mastercard - Your path to credit success starts here. Whether you're starting from scratch or rebuilding your credit.

Keep ReadingYou may also like

Mission Lane Visa® Fair to High credit! Limit up to $ 6.000

Mission Lane Visa® - Your path to financial freedom. Unlock a credit limit of up to $6,000 and explore a world of rewards and cashback.

Keep Reading

Mortgage Passport – For bad credit! Loan up to $350.000

Don't let bad credit hold you back from owning a home. Discover Mortgage Passport - Your key to a $350,000 mortgage.

Keep Reading

Petal® 1 for fair credit! Credit limit up to $ 5.000

Unlock financial flexibility with Petal® 1 - the credit card designed for fair credit holders. Enjoy a credit limit of $5,000 no annual fees.

Keep Reading