Credit Cards

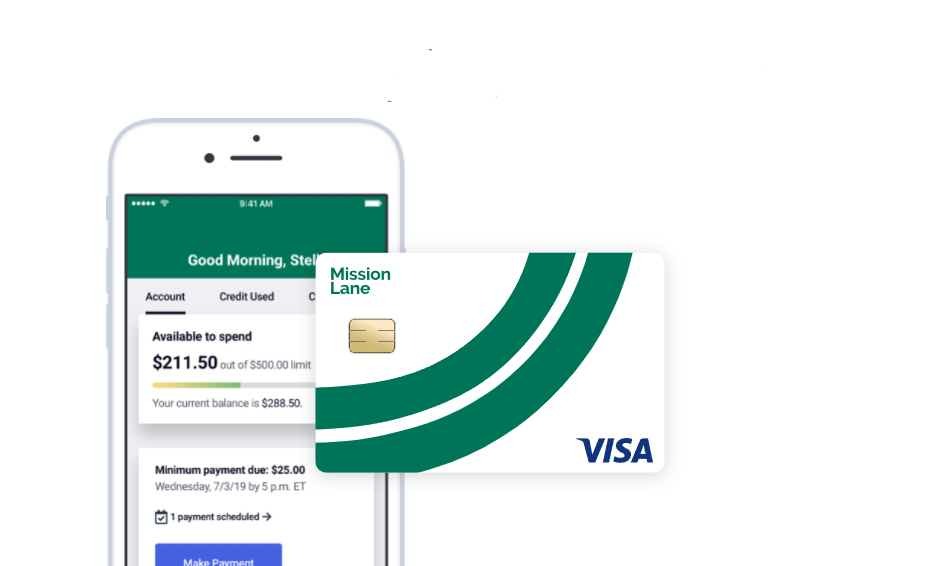

Mission Lane Visa® Fair to High credit! Limit up to $ 6.000

Discover the power of Mission Lane Visa® with its generous credit limit of up to $6,000 and a flexible rewards program. Build your credit while enjoying a competitive APR and no annual fee. Apply now for fair to high credit scores!

Advertisement

Mission Lane Visa for everyone – Know more about the card

In the fast-paced modern world, credit cards have evolved into an indispensable financial tool for countless individuals. Among the diverse array of credit cards available, the Mission Lane Visa® stands out as a compelling option for individuals with fair to high credit scores, boasting a credit limit of up to $6,000.

This article will delve into the intricate details of the Mission Lane Visa®, exploring its advantages, disadvantages, the requisite credit score, and the process to acquire this credit card.

Learn More About Mission Lane Visa®

The Mission Lane Visa® represents a credit card tailored to meet the needs of individuals with fair to high credit scores. Issued by the esteemed Mission Lane LLC, a financial institution renowned for its customer-centric approach and innovative credit solutions, this card offers a plethora of features and benefits, making it an appealing choice for a wide range of consumers.

See Also: Details of Mission Lane Visa®

Let’s delve into the key specifics of the Mission Lane Visa® that set it apart from other credit cards in the market.

Advantages

- Generous Credit Limit: One of the primary advantages of the Mission Lane Visa® is its considerable credit limit, extending up to $6,000. This enables cardholders to make significant purchases and effectively manage their expenses.

- Flexible Rewards Program: The credit card offers a versatile rewards program, allowing users to accrue points for each dollar spent on eligible purchases. These points can be redeemed for cashback, travel rewards, or merchandise, adding extra value for cardholders.

- No Annual Fee: In contrast to numerous other credit cards, the Mission Lane Visa® does not impose an annual fee. This renders it an economical choice for consumers seeking to avoid unnecessary expenses.

- Competitive APR: The card boasts a competitive Annual Percentage Rate (APR), which can be as low as 14.99%, contingent upon the applicant’s creditworthiness. This feature proves especially advantageous for those planning to carry a balance on their card.

- Credit Building Opportunities: For individuals looking to build or enhance their credit score, the Mission Lane Visa® provides a valuable opportunity. Responsible card usage, punctual payments, and prudent credit utilization can positively impact the cardholder’s credit profile.

Disadvantages

- Limited Availability: While the Mission Lane Visa® offers numerous benefits, it is currently exclusively available to U.S. residents. This may present a drawback for international travelers or individuals residing outside the United States.

- Foreign Transaction Fee: Cardholders should be aware that using the Mission Lane Visa® for transactions in foreign countries may incur a foreign transaction fee. Consequently, it may not be the most ideal card for frequent international travelers.

And What Credit Score Do I Need?

To be eligible for the Mission Lane Visa®, a fair to high credit score is typically required. While specific score requirements are not publicly disclosed, having a credit score ranging from 580 to 750 or higher enhances the likelihood of approval.

How to Obtain the Mission Lane Visa®

Acquiring the Mission Lane Visa® is a straightforward process that can be completed online. Prospective applicants can visit the official Mission Lane website and complete the application form.

The Mission Lane Visa® stands as an exceptional option for individuals with fair to high credit scores, presenting a substantial credit limit of up to $6,000, a versatile rewards program, and a competitive APR.

While it does come with certain limitations, such as being available only to U.S. residents and foreign transaction fees, its advantages outweigh the drawbacks for many consumers.

If you are seeking a credit card to augment your purchasing power and bolster your credit profile, the Mission Lane Visa® may prove to be the perfect choice for you. Apply today and experience the convenience and benefits it has to offer!

About the author / Beatriz Martinez

Trending Topics

PrimeLending Mortgage – For Fair credit! Loan up to $1.089.000

PrimeLending Mortgage - Where fair credit scores find a home. Enjoy flexibility, high loan limits, and personalized service.

Keep Reading

Apply for Chase Freedom Flex℠ Credit Card: limit up to $2.500

Chase Freedom Flex℠: Unleash the power of rewards! Get 1% cashback on all purchases, plus exciting quarterly bonuses. No annual fee.

Keep ReadingYou may also like

Petal® 1 for fair credit! Credit limit up to $ 5.000

Unlock financial flexibility with Petal® 1 - the credit card designed for fair credit holders. Enjoy a credit limit of $5,000 no annual fees.

Keep Reading

Bank of America Cash Rewards: Fighting Credit Card Debt!

Manage your credit card debt wisely with a reliable card like Bank of America Cash Rewards. Explore a $1,200 credit limit, cashback rewards, and various credit scores.

Keep Reading

Apply for Reflex Mastercard® credit card even in debt

Turn your credit story around with Reflex Mastercard – the credit solution designed to empower individuals with limited credit history.

Keep Reading