Credit Cards

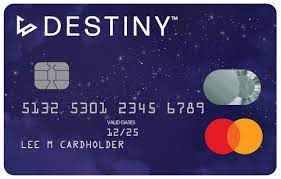

Apply now for the best Destiny Mastercard – limit up to $1.000

Take charge of your finances and pave your path to success with the Destiny Mastercard. Enjoy generous credit limits, no annual fees, and personalized financial tools to help you achieve your goals. Apply now and embark on a journey of financial empowerment.

Advertisement

Apply for Destiny Mastercard online with a $1.000 credit limit

In a world where credit opportunities can be elusive for those without a credit history, the Destiny Mastercard shines as a ray of hope. This revolutionary credit card offers a fresh start to individuals seeking to establish their creditworthiness. With a credit limit of up to $1,000, the Destiny Mastercard opens doors that were once closed for credit newcomers.

In this blog article, we will delve into the wonders of the Destiny Mastercard, exploring how to apply for this card online and through the app. Additionally, we will compare the Destiny Mastercard with the SoFi Credit Card to help you make an informed decision. So, buckle up and embark on a journey towards building a strong credit foundation!

How to Apply for Destiny Mastercard Online

Applying for the Destiny Mastercard online is a convenient and straightforward process. The prospective cardholder can visit the official website and navigate to the Destiny Mastercard application page. Here, they will be prompted to provide essential personal and financial information for evaluation.

After submitting the application, the financial team behind Destiny Mastercard will assess the information provided and determine the applicant’s eligibility. This inclusive approach makes the Destiny Mastercard an attractive option for individuals with no credit history.

Applying for Destiny Mastercard via the App

For tech-savvy individuals who prefer a seamless mobile experience, applying for the Destiny Mastercard through the app is the way to go. The Destiny Mastercard app offers a user-friendly interface that guides applicants through the application process step by step.

Users can securely input their details, and the app facilitates a quick submission. This mobile application option ensures a convenient and efficient way to access credit opportunities, even for those on the go.

Destiny Mastercard vs. SoFi Credit Card: A Comparative Overview

Now, let’s compare the Destiny Mastercard with the SoFi Credit Card to better understand their respective features and benefits. Both cards aim to serve individuals with limited or no credit history, but they may cater to different needs and preferences.

Destiny Mastercard: Key Points

- Credit Limit of up to $1,000: The Destiny Mastercard offers a credit limit of up to $1,000, providing room for essential purchases and financial flexibility.

- No Credit History Required: One of the standout features of the Destiny Mastercard is its inclusive approval process that doesn’t solely rely on an established credit history.

- Global Acceptance: As a Mastercard, the Destiny Mastercard is accepted worldwide, making it a reliable companion for international transactions.

- Opportunity for Credit Building: Responsible usage of the Destiny Mastercard can help cardholders establish a positive credit history, opening doors to future credit opportunities.

SoFi Credit Card: Key Points

- Variable Credit Limit: The credit limit for the SoFi Credit Card varies based on the applicant’s creditworthiness and financial evaluation.

- No Annual Fee: Unlike some credit cards, the SoFi Credit Card boasts no annual fee, making it an attractive option for those seeking to minimize expenses.

- Exclusive Member Benefits: SoFi Credit Cardholders can access exclusive benefits and perks through the SoFi membership program.

- Credit Score Monitoring: SoFi provides credit score monitoring, allowing cardholders to stay informed about their credit health.

If the Destiny Mastercard has captured your interest, take the next step towards building your credit by clicking the link below to apply. Additionally, consider exploring the SoFi Credit Card for an alternative credit-building opportunity.

Remember, responsible credit management is the key to a secure financial future. Don’t miss this chance to take control of your credit destiny!

About the author / Beatriz Martinez

Trending Topics

Apply for PrimeLending Mortgage – For Fair credit! Loan up to $1.089.000

Don't let fair credit hold you back! PrimeLending Mortgage offers fair credit borrowers loans up to $1.089.000 with competitive rates.

Keep Reading

Apply for Surge Mastercard for people in debt! Credit limit up to $550

Experience the rewards of responsible credit usage with Surge Mastercard. Say goodbye to limited options and hi for financial opportunities.

Keep Reading

Learn how to apply for LoanDepot Mortgage – Your solution for challenged credit! Loan up to $700.000

LoanDepot Mortgage: Your solution for homeownership. Access up to $700,000 in loans, regardless of your credit history.

Keep ReadingYou may also like

Maximize Your Rewards with the Citi Double Cash Card: No Annual Fee Required!

Citi Double Cash Credit Card: NO ANNUAL FEE with a credit limit of up to $6,000 and unlock a world of rewards! Find out more!

Keep Reading

Apply for Capital One Platinum Limit up to $1.300!

Capital One Platinum Secured Card - your pathway to credit improvement. Start with a refundable security deposit and enjoy.

Keep Reading

Apply for Petal® 1 for fair credit! Credit limit up to $ 5.000

Don't let bad credit hold you back. Explore Petal® 1 for bad credit and start rebuilding your financial standing. No annual fees!

Keep Reading